Paying Your Taxes

Due to ongoing postal service negotiations, we encourage residents to use alternative payment methods rather than mailing bill payments.

City of Spruce Grove property taxes are levied in accordance with the Municipal Government Act. Annual levies cover the period from January 1 to December 31 of the current year and are mailed in May of each calendar year. Payments are due June 30. Your entire tax bill can be paid at any time, but there is no discount for early payment.

If you haven't received your tax bill by the second full week of June, please contact us by phone at 780-962-7634 ext 119 or by email.

Payment options

We are continuing to encourage residents to make tax payments through credit card, online banking, or by using our secure drop box beside the main doors on the southeast side of City Hall. Please see below for more details on payment options during this time.

Credit card

The City of Spruce Grove is now accepting online payments with select credit cards (Visa and MasterCard) through the secure OptionPay System (with applicable third-party fees). Note that all processing fees are charged by OptionPay and are not received by the municipality. Payments can be made via credit card online or in-person at City Hall. For those with credit card rewards, rewards will be earned on the entire purchase, including processing fees.

Payments can take up to three days to be received by the municipality, so please allow for this processing time while making your payment. Please be aware of your daily and/or transaction processing limit when making your property tax payment. For optimal performance, please use Google Chrome or Firefox web browsers when accessing OptionPay. Currently, only property taxes can be paid via OptionPay.

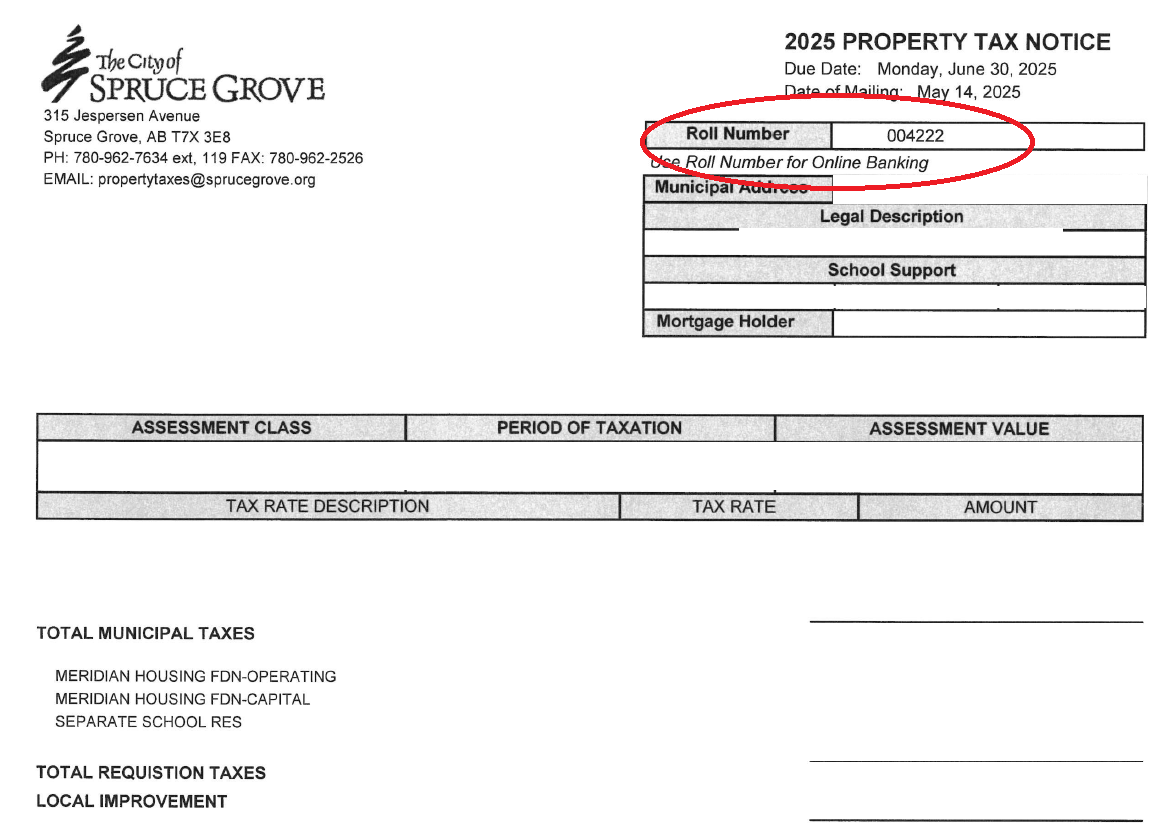

When completing payment online, please ensure you enter your roll number exactly as it appears on your property tax notice (see where you can find your roll number on the property tax notice below). The City is not responsible for payments being applied to incorrect accounts due to mistyped roll numbers.

Please note that clicking this link will take you to a third-party external site, leaving the City of Spruce Grove website. The City is not responsible for the content of external sites.

Monthly installments

Our convenient monthly pre-authorized payment plan is an easy and effective way of budgeting for your property taxes and avoiding late payment penalties.

Please note: monthly pre-authorized property tax payments can not be made by credit card.

Complete the pre-authorized tax payment form and attach a void cheque or a direct debit form from your financial institution. Submit the completed forms by email, by mail or through our secure drop box beside the main doors on the southeast side of City Hall.

Equal monthly payments will be withdrawn directly from your bank account on the 17th of each month. From January to May, the monthly withdrawal is estimated based on the previous year’s property taxes. Your monthly payment will be adjusted in June, and will be stated on your annual Property Tax Notice.

To find out your balance and installment amounts, or to cancel your pre-authorized payments call us at 780-962-7634 ext. 119. When pre-authorized payments are cancelled, all taxes become due on June 30 of the current year.

By mail

Include the remittance stub with your payment to ensure that it is credited to the correct tax account and mail it to Spruce Grove City Hall.

Drop box at City Hall

You may pay by cheque or money order payable to The City of Spruce Grove at City Hall. Record your tax roll number on your cheque or money order and deposit your payment into the secure drop box beside the main doors on the southeast side of City Hall. You may post-date your cheque to on or before June 30. Credit cards are not accepted for tax payments.

Always include the remittance stub with your payment to ensure that it is credited to the correct tax account.

At your financial institution

Payments made through your financial institution are not automatically received by the City. To avoid late payments and the associated fees make your payment by this method at least three business days before the penalty date.

You may also use your financial institution’s telephone or internet banking services. Be sure to enter your tax roll number when using this method to ensure your payment is applied to the correct account.

Late payments

All current year taxes remaining unpaid after June 30, are subject to a penalty applied at 4.5% non-compounding rate, on the first day of July, September and November of the year they are levied. All tax arrears unpaid after December 31 of the year that they are levied are subject to a penalty applied on the first day of January and March at a compounding rate of 7%.

If taxes are in arrears for more than a year

Under the Municipal Government Act, a municipality can file a Tax Recovery Notification against the title of any property where taxes are in arrears for more than one year. Notifications are filed before April 1 of each year. All costs incurred in the tax recovery process are charged against the property on which the notification is filed.

If taxes remain unpaid by March 31 of the year following the filing of a Tax Recovery Notification, the property will be offered for tax recovery sale by public auction.